How do we align the brand to our new strategy?

When one of the UK’s largest high-street lenders restructured its commercial banking franchise to deliver greater scale, efficiencies and enhanced service for its customers, we were asked us to develop a brand and marketing platform to help build the reputation it deserved.

- For reasons of client confidentiality, we are unable to share the name of the lender, its strategic aims or our work to develop the brand platform, but we hope you find our approach and the principles outlined helpful.

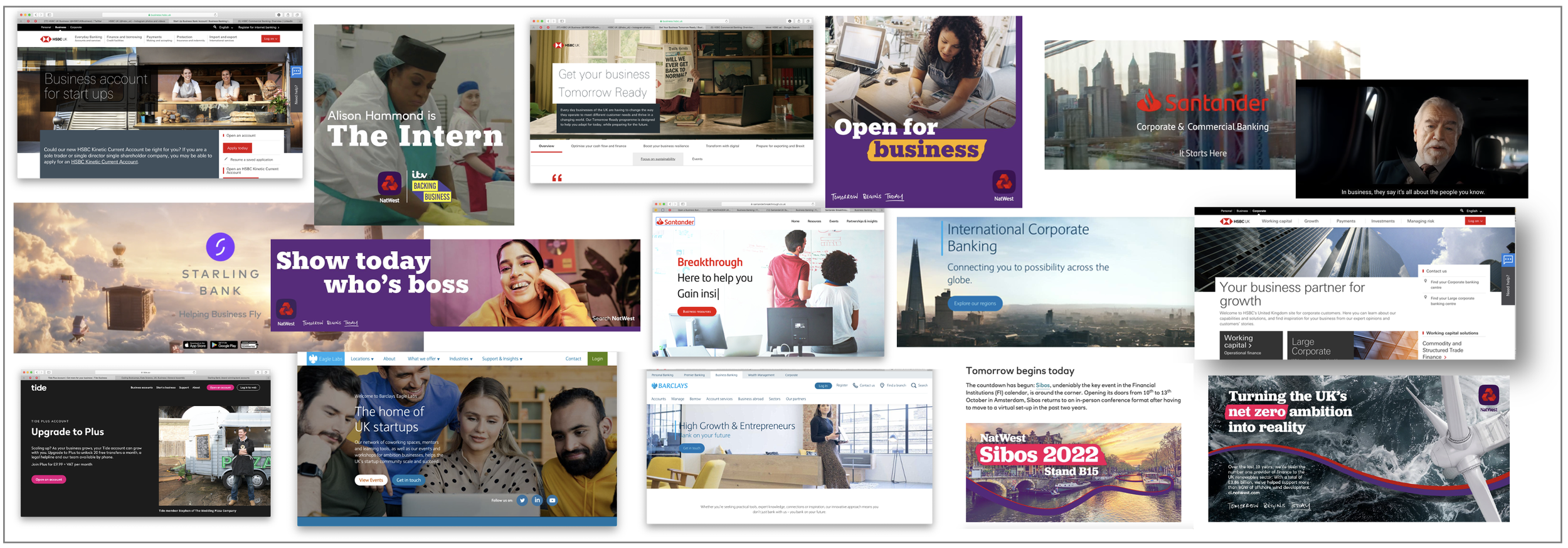

As a franchise, the commercial bank represented four businesses, each focused on a particular customer segment, ranging from start-ups and SMEs to mid-sized companies, corporates and institutions. Although the bank had increased its marketing to all these segments, reputation tracking revealed little had changed in the perceptions of its customers.

What was missing was a cohesive and overarching story for why the lender is the UK’s leading bank for business.

Marketing across the bank may have been using the brand identity and campaign strapline, but the messaging overall had not sufficiently joined up the brand and business strategy to deliver the relevant meaning necessary to change customer and stakeholder perceptions.

We needed to develop the brand platform and align it more explicitly to the bank’s strategic goals to gain leadership support, and to unlock the benefits of the new strategy for each of its customer segments.

A joined-up approach

We developed the brand platform with insights taken from our review of the bank’s capabilities, customer perceptions, and the positioning of key competitors.

A key aspect of our work was to involve and engage leaders from across the four franchise businesses. We used one-to-ones to fully immerse ourselves in their ambitions and aims for the business, and to understand how the brand would need to adapt for each segment as a platform for growth.

When combined, our insights highlighted the most compelling features of the bank’s proposition (brand drivers) that would align the strategic aims of the bank with the needs of its customers and drive meaningful difference for the brand.

Our primary deliverable was a messaging house created specifically for the commercial bank with the developed brand platform at its core.

In addition to working with the brand team, we also supported marketing teams to cascade the brand platform through a series of customer propositions, each supported with relevant proof-points and tailored to the needs of each customer segment. The resulting messaging house was used to drive messaging internally, as well as through corporate comms and marketing, to clearly and consistently articulate to all audiences why the lender was the UK bank for business.

Working closely with both marketing and brand leaders we developed a strategic marcomms framework. The decision-tree structure combined the strategic aims and brand platform to help marcomms teams consider the most relevant channels, activity and messaging, and by linking to other brand assets, the framework brought together all the ingredients necessary for the bank to build the reputation it deserved.

Deliverables

One-to-one interviews to engage leaders and gain support for the brand

Brand platform and narrative to position lender as UK’s bank for business

Messaging house to drive consistent messaging across all internal and external stakeholders

Strategic marcomms framework to align marketing activity with strategic aims

Workshops with marketing and coms teams to road-test and launch brand platform, messaging house and marcomms framework.

Impact

Brand used to drive growth

Brand platform used to build meaningful difference

Marcomms framework used to grow customer consideration

You might also like

How to find the right creative partner.

How to keep your brand fresh and ahead of the rest.

How we used brand to help Uppingham School take the pioneering lead.